how to calculate stock up rate

Use FundVisualizer to chart thousands of ETFs across 80 different performance metrics. The formula is shown above PE x EPS Price.

Computing the future dividend value B DPS A.

. Take the percentage total return you found in the previous step written as a decimal and add 1. Enter the purchase price per share the selling price per share. Select the time units you wish to use when entering the number of periods.

Take the division of total costs by the average inventory. Just follow the 5 easy steps below. Add them up and you get your valuation.

In this example add. According to this formula if we can accurately predict a. Add together your investments in individual stocks all-stock investment funds and stock holdings in hybrid funds to determine your overall investment in stocks.

First you calculate a companys excess returns. To calculate this analysts will multiply the market price by the companys trailing 12-month earnings. The Total Number of Products is easily determined using.

Enter the number of time units between the beginning. Finding the growth factor A 1 SGR001. To obtain the Number of Products Out of Stock is therefore simply the SUM of these tests ie.

The stock turnover ratio formula is the cost of goods sold divided by average inventory. The Stock Calculator is very simple to use. GR ending value beginning value 1n - 1 where n is the number of years assuming interest is compounded annually.

Finally the formula for a stock turnover ratio can be derived by dividing the cost of. This method of predicting future price of a stock is based on a basic formula. Calculate per share rate of return on a stock sale in terms of current yield and annualized holding period yield.

Suppose you buy stock for 10 a share. Average Inventory Inventory at the Beginning of the Period Inventory at the End of the Period 2. As defined by trading partners the percent of retail locations stores or SKUs with a positive on-hand balance of a particular item or the percent of retail locations.

Heres an example. Additionally look at how the stock has done year to. Choose a period of time to evaluate your stocks performance such as a year or a 6-month period.

Dividends reduce the value of the stock but the shareholders receive the. Enter the number of shares purchased. Consider the actual performance of the stock over a period as though you had invested in it on that first day of the period.

Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at. The stock pays a dividend of 10 cents per quarter which means for every share you own you will receive 40. SUM CURRENT_STOCK 0.

For example if there are 10000 outstanding common shares of a company. The stock average calculator is a free online tool for calculating the average price of stocks and the average down calculator is best for averaging. Next you calculate the terminal value.

Book value per share Stockholders equity Total number of outstanding common stock. To get an accurate values just add the initial and final inventory of the specific time period and then divide it by two. The algorithm behind this stock price calculator applies the formulas explained here.

The stock turnover ratio determines how soon an enterprise sells its goods and products and replaces its. Find your average daily return to evaluate your stocks. Add any dividends paid to the value of the stock at the end of the period to figure the actual closing value.

Heres how it works. Then raise this to the power of 1 divided by the number of years you held. Ad Compare ETFs by using over 80 performance and risk metrics.

Calculating growth rate reveals how your company is trending. For example if you brought. In this case the formula for growth rate is.

Enter the ending earnings per share.

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Weighted Average Cost Of Capital Wacc Excel Formula Cost Of Capital Excel Formula Stock Analysis

Why Do We Need To Invest Now Invest And Up Bitcoin Generator Bitcoin Investing

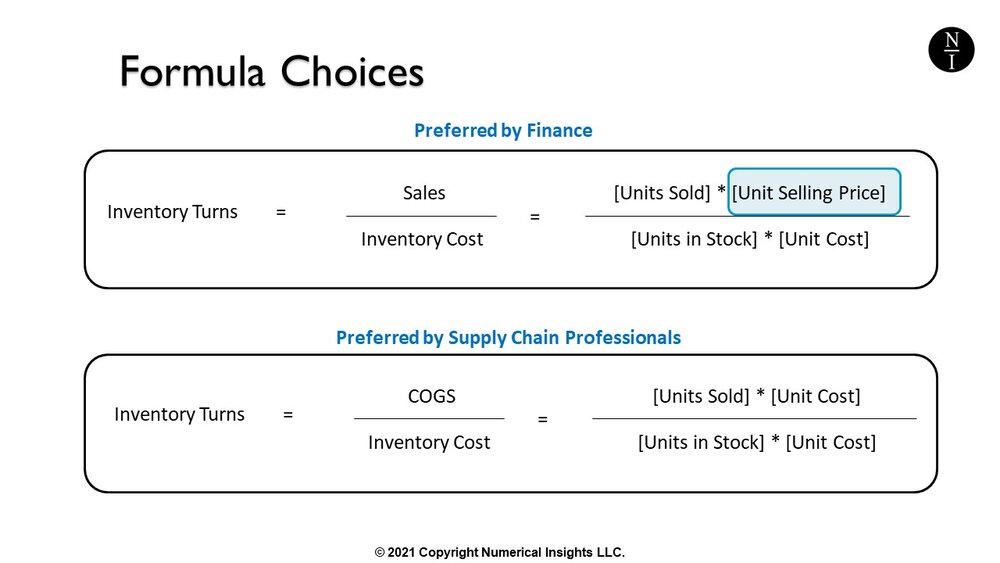

Formula To Calculate Inventory Turns Inventory Turnover Rate

What Is A Small Cap Stock Small Cap Stocks Small Caps Finance Planner

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investing Investment Analysis Analysis

Wealth Maximization Financial Management Wealth Management Wealth

Intrinsic Value Formula Example How To Calculate Intrinsic Value Intrinsic Value Intrinsic Company Values

Irr Internal Rate Of Return Definition Example Financial Calculators Balance Transfer Credit Cards Cost Of Capital

Online Tool To Calculate Portfolio Returns Investing Money Investing Reading Recommendations

Invest The Right Sip Amount Systematic Investment Plan Investing Investment Business Ideas

Short Term And Long Term Capital Gains Tax Rates By Income In 2020 Capital Gains Tax Tax Rate Capital Gain

Step 2 Calculate The Cost Of Equity Stock Analysis Cost Of Capital Step Guide

Irr Vs Roi Infographics Here Are The Top 4 Difference Between Roi And Irr Personal Finance Infographic Investing

How To Calculate The Landed Cost Of Imported Products Incodocs Cost Of Goods Cost Stock Photos

How To Calculate Net Present Value Inbound Marketing Strategy Calculator Marketing Strategy

Discount Rate Formula How To Calculate Discount Rate With Examples